Without using automated billing software, can you help your company —

- avoid 250 hours of manual invoicing every month?

- close its books 5 weeks faster than usual?

- save 120 engineering hours a month?

- cut monthly costs worth $12K?

Mostly not unless you’ve taken inspiration from Zenskar’s customer stories.

That’s why 65% of finance leaders aimed to automate at least half of the functions in 2023.

And here’s why US B2B companies are increasing tech expenditure:

- To improve productivity (68%)

- To improve payment efficiency (60%)

But what’s making B2B SaaS brands consider automated billing systems? Let’s find out.

What Problems is Automated Billing Software Solving for B2B SaaS Brands?

Here’s a list of 5 problematic situations, the suffering that follows, and solutions to the problems if you’re using the right automated billing software.

1. Constantly correcting your team’s manual billing errors.

Manual billing processes are fraught with risks and errors, leading to inefficiencies and dissatisfaction. Streamlining these processes with automated solutions can significantly improve accuracy and reduce time spent on corrections.

Situation

Your team is buried in spreadsheets, manually entering billing data every month. This tedious process not only eats up valuable time but also leaves room for errors.

You oversee the monthly financial close and notice recurring inaccuracies in the billing data. Correcting these after your team manually enters them is costly and diverts resources from strategic analysis and forecasting.

Suffering

Recently, an overlooked error caused a significant invoice delay, straining an important client relationship and disrupting your cash flow.

This hiccup highlighted how manual billing is a bottleneck that prevents your company from scaling and quickly adapting to market changes.

Solution

Using a SaaS invoicing tool, automatically generate and send invoices based on predefined criteria, reducing the potential for errors.

2. Difficulty scaling the billing system with the company’s growth.

As your company grows, the demand on your billing system multiplies. Scalability issues can hamper your ability to manage increasing transactions and customer data efficiently.

Situation

As your SaaS company acquires more customers, the existing billing system becomes increasingly cumbersome to manage, making it challenging to introduce new pricing plans quickly.

Suffering

This limitation hampers your ability to respond to competitive market pressures and customer demands.

For example, when attempting to roll out a new usage-based pricing model, you’re bogged down by the need for extensive manual configuration, delaying market entry and potential revenue.

Solution

An automated billing software equipped with scalable features enables rapid onboarding of new pricing plans and accommodates a growing customer base without extra manual effort. It allows for quick adaptation to market demands and customer needs.

3. Engineering resources diverted to address billing system issues.

Frequent billing system issues not only drain valuable engineering resources but also divert focus from core product development. Automating your billing processes can free up your team to focus on innovation.

Situation

Your engineering team is frequently pulled away from developing new features to address billing system issues, slowing down product innovation.

Suffering

When most of the engineering bandwidth is consumed in solving billing problems, it distorts product releases and updates and gives competitors an edge.

For instance, a critical feature that could significantly enhance user experience is put on hold because your engineers are fixing the billing code instead.

Solution

Automated invoicing systems with no-code and low-code solutions help your team handle all billing intricacies and workflows, freeing your engineers to focus on product development.

4. Inadequate support in managing entitlements and access control.

Managing entitlements and access controls effectively is crucial for maintaining data security and operational integrity. However, inadequate support in these areas can lead to vulnerabilities and unauthorized access, compromising both security and compliance.

Situation

You’re launching a premium feature tier but struggle to control access based on your user base’s diverse subscription levels.

Suffering

This lack of granular control over who gets access to what and when can lead to unauthorized usage, diminishing the perceived value of your premium offerings and complicating billing.

Solution

You can define and control access rights across different subscription tiers easily using automated billing software.

This ensures that customers only use the features they’re entitled to, enhancing service value and simplifying billing processes.

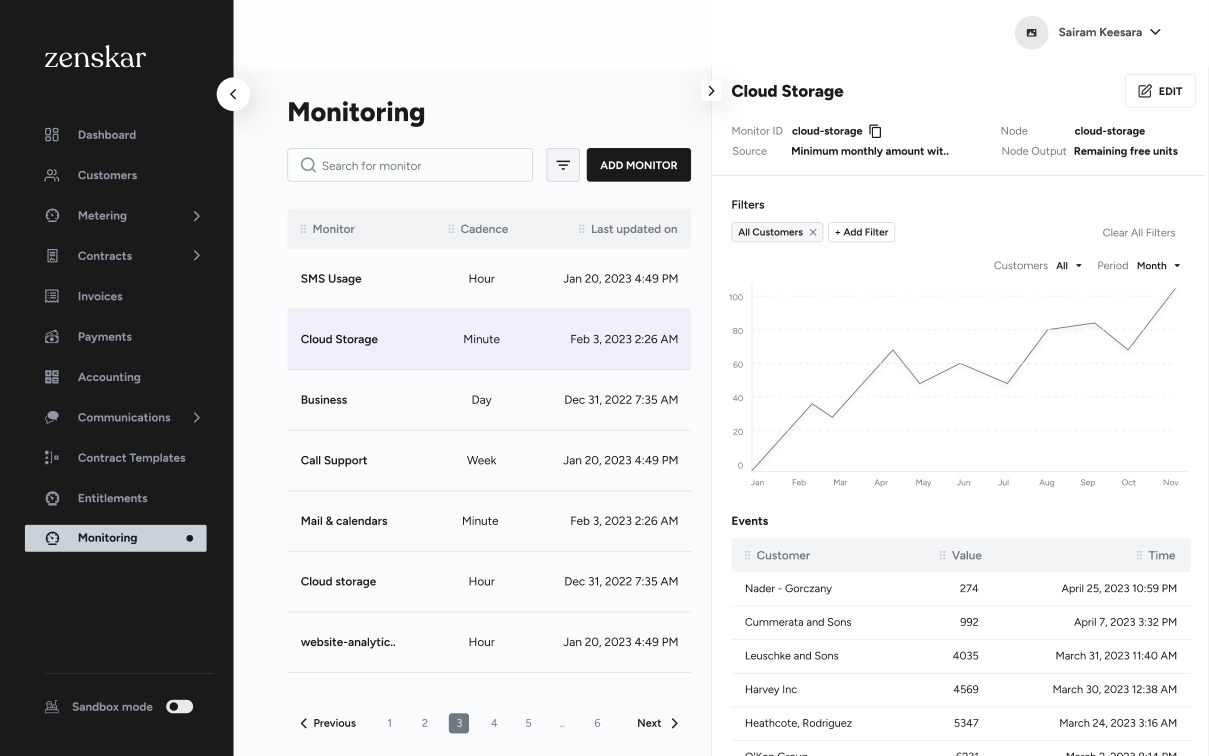

5. Lack of real-time analytics for strategic decision-making.

Without access to real-time analytics, making informed strategic decisions becomes challenging. This lack of insight can hinder one’s ability to respond effectively to market changes.

Situation

You’re making critical business decisions based on outdated or incomplete financial data because your current systems can’t provide real-time insights.

Suffering

This delay in accessing up-to-date information leads to missed opportunities and reactive strategies. For instance, you’re unable to quickly adjust pricing in response to a sudden shift in market demand, putting you at a disadvantage compared to more agile competitors.

Solution

Some automated billing systems offer real-time analytics and customizable dashboards, giving your team instant access to financial performance, customer growth, and usage patterns.

This empowers it to make informed strategic decisions swiftly, ensuring your product stays competitive and responsive to market dynamics.

6. Revenue recognition process having compliance issues.

Revenue recognition, especially with compliance standards like IFRS and GAAP, is challenging. Automated systems can help ensure accuracy and adherence to these regulations.

Situation

Your revenue recognition process is manual, slow, and erroneous, making it difficult to comply with standards like ASC 606.

Suffering

This rigidity in revenue recognition could lead to financial discrepancies, impact your company’s audit readiness, and potentially result in non-compliance penalties.

Solution

You can automatically generate compliant journal entries and reports with an automated billing tool, reducing the time and effort required.

This ensures accuracy, audit readiness, and compliance with financial regulations, thus safeguarding your company’s reputation and financial integrity.

7. Facing difficulty in managing and reducing customer churn.

Customer churn can be exacerbated by billing issues such as inaccuracies or delays. An automated, transparent billing system can enhance customer trust and satisfaction, thus reducing churn rates.

Situation

You notice an increasing trend in customer cancellations but lack the tools to analyze the underlying reasons or predict which customers might leave next.

Suffering

Without the ability to identify at-risk customers early, you’re unable to implement targeted retention strategies. This reactive stance means you’re always a step behind, leading to a continuous cycle of loss and acquisition that hampers growth.

Solution

Go for automated billing features that enable monitoring customer usage and engagement patterns, alerting you to potential churn risks before they lead to cancellations.

With this information, you can proactively address customer concerns, personalize retention efforts, and ultimately reduce churn rates, securing a more stable revenue stream.

8. Integration with existing tech stacks becomes challenging.

Integrating billing systems with other tech stacks should enhance functionality, not complicate it. Challenges in integration can lead to operational silos and inefficiencies.

Situation

Your billing system operates in isolation, leading to significant manual effort in importing and exporting data between itself and other systems like CRM and ERP.

Suffering

A siloed approach results in inefficiencies, data inconsistencies, and a higher risk of errors, which can impact overall operational effectiveness and decision-making capabilities.

Solution

Modern-day billing automation software also comes with extensive integration capabilities that can connect with your existing tech stack, ensuring smooth data flow between systems.

This eliminates manual data transfer, reduces errors, and improves efficiency, allowing your teams to focus on more strategic tasks.

9. Facing trouble adapting complex, customizable pricing models.

Adapting to complex, customizable pricing models requires flexibility that manual or outdated systems cannot provide. Automation allows for rapid adaptation to market demands and customer needs without extensive backend changes.

Situation

You’re trying to revamp your pricing strategy to include both subscription tiers with various perks and a usage-based model depending on customer consumption. Still, your current billing system can’t accommodate these complexities without significant manual intervention.

Suffering

The inability to swiftly adapt your pricing directly impacts your market competitiveness.

For instance, launching a new feature that requires a different pricing model takes too long, allowing competitors to capture your target market first. This rigidity in pricing adaptation also frustrates customers seeking flexibility and customization in how they’re billed.

Solution

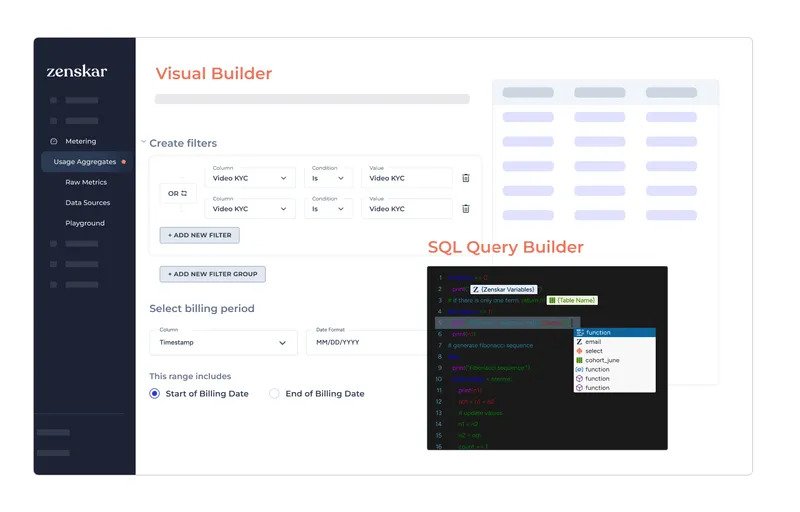

You can integrate both complex subscription models and dynamic usage-based pricing within the same system using automated billing software.

This flexibility allows for quick adjustments and testing of new pricing strategies without backend coding, significantly reducing time to market and enhancing customer satisfaction with tailored billing options.

Here’s how specific features of automated billing software solve major pain points:

| Pain Point | Feature | How It Works | Benefits |

|---|---|---|---|

| Manual billing is time-consuming and error-prone. | Automated Invoicing | Automatically generates and sends invoices based on user activity and subscription details. | Reduces errors, saves time, improves accuracy. |

| Scaling billing operations is a struggle. | Scalable Infrastructure | Adapts to growing transaction volumes without additional manual input or system changes. | Supports business growth without added complexity. |

| Engineering time wasted on billing fixes. | No-code Configuration | Allows non-technical users to set up and modify billing rules without engineering support. | Frees up engineering resources for product development. |

| Complex and variable pricing models are hard to manage. | Flexible Pricing Management | Enables easy setup of various pricing strategies through a user-friendly interface. | Simplifies pricing adjustments and enhances market responsiveness. |

| Usage-based pricing adaptation is challenging. | Usage Tracking and Billing | Tracks user consumption and accurately bills based on usage without manual intervention. | Facilitates the adoption of usage-based models and aligns costs with customer value. |

Wrap: Before and After Using Automated Billing Software

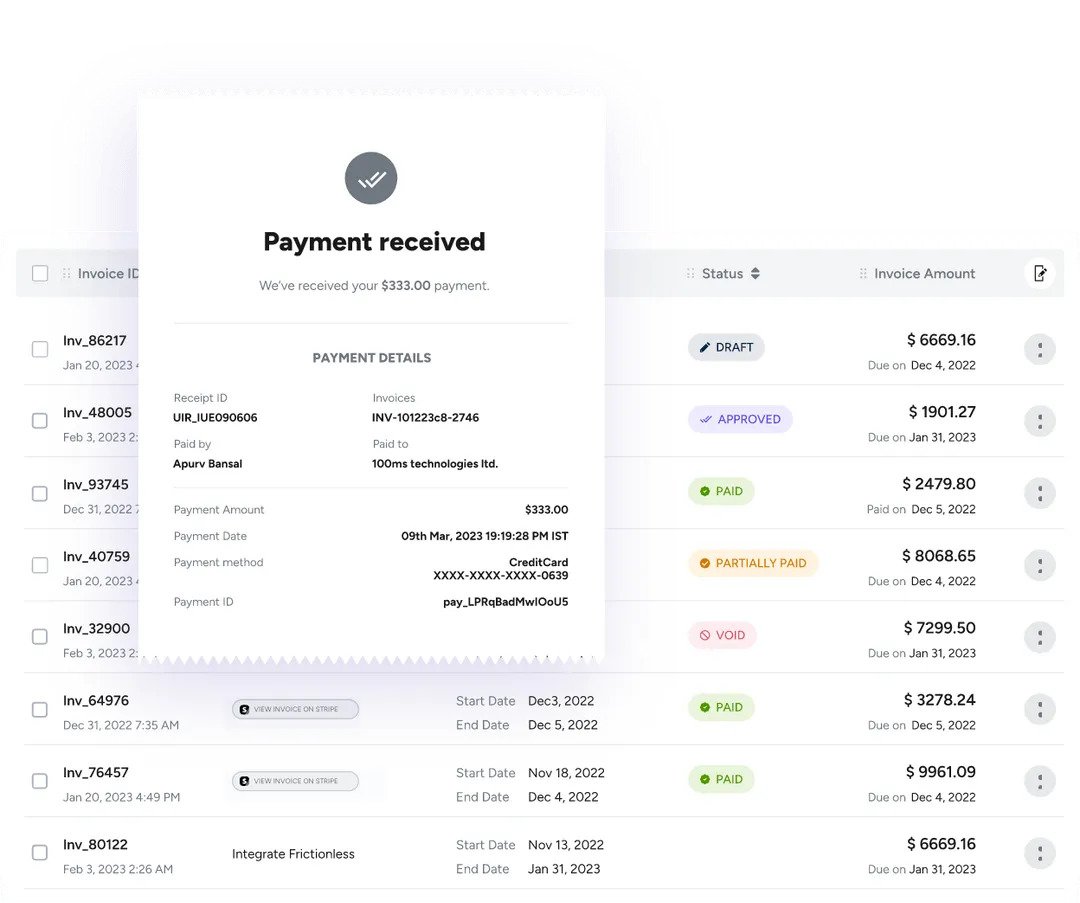

Zenskar’s billing and pricing infrastructure takes good care of all the pain points you read in this blog. Here’s a glimpse of the before-and-after effect of automated billing:

| Scenario | Before Automated Billing | After Automated Billing | Impact |

|---|---|---|---|

| Launching a New Pricing Model | Weeks of manual setup and testing. Prone to errors. | Days to configure and roll out with automated validation. | Reduced time to market and increased pricing agility. |

| Handling End-of-Month Billing Surges | Overtime work for finance teams, delayed invoices. | Smooth processing, on-time invoices with no extra staffing. | Improved efficiency and timely revenue recognition. |

| Customizing Invoices | Manual customization for each client, increasing workloads. | Automated templates adapt to client specifics dynamically. | Personalized customer experience with less effort. |

| Updating Subscription Plans | Manual processes are prone to errors, impacting customer trust. | Seamless updates in real-time without affecting service. | Enhanced customer satisfaction and trust. |

| Integrating New Payment Methods | Weeks of development work, testing, and deployment. | Quick setup through pre-built integrations. | Faster adoption of preferred customer payment methods. |

There’s more to it than just customizations, integrations, and automations. Zenskar consistently achieves increased bandwidth, minimized resource costs, and maximized product revenue for B2B SaaS organizations.

People Also Ask these FAQs

Your B2B SaaS competitors have the same intent as you when searching about automated billing systems. Quickly find and fulfill your billing and invoicing queries before they get a bite from this guide!

What is automated billing software?

Automated billing software manages your invoicing and payments automatically. Without such software, you might rely on manual processes prone to errors. Automated solutions streamline these processes, improving accuracy and efficiency.

Does automated billing software solve manual billing errors?

Yes, automated billing software significantly reduces manual billing errors. In contrast, manual processes are susceptible to human error, which can be costly. Automation ensures consistency and accuracy in your billing operations.

Can you scale existing billing systems with company’s growth?

Yes, automated billing systems are designed to scale with your company’s growth. Traditional systems may struggle to keep up without significant upgrades. Automated solutions adjust dynamically to increased demand, ensuring reliability as your business expands.

Do automated billing systems save engineering resources?

Yes, automated billing systems save significant engineering resources. Manually managing billing requires continuous developer input. By automating, you free up your engineering team to focus on product development instead of billing issues.

Can you control user access with automated billing?

Yes, you can control user access with automated billing software. Without such controls, sensitive billing data might be at risk. Automated systems provide robust access management features, enhancing security and compliance.

What is revenue recognition in billing?

Revenue recognition in billing is the accounting process that dictates the timing and conditions under which revenue is recognized in the financial statements. It ensures revenue is recorded when earned, not merely when cash is received. This principle is crucial for reflecting true financial performance, distinguishing it from the billing process, which is about requesting payments.

What happens without proper revenue recognition?

Without adhering to proper revenue recognition principles, a company’s financial reporting might mislead stakeholders about its actual financial health. This can lead to decisions based on inaccurate financial data, potentially harming the company’s strategic planning and investor confidence.

How does revenue recognition benefit SaaS business?

Implementing accurate revenue recognition methods ensures compliance with accounting standards and provides a realistic view of income and financial health. This not only bolsters investor and market confidence but also aids in strategic financial planning and reporting.

Can you reduce customer churn using automated billing software?

Yes, automated billing software can help reduce customer churn. Inefficient billing can frustrate customers, leading to higher churn rates. By ensuring accurate and timely billing, you improve customer satisfaction and retention.

Which is the best billing integration software in India?

Zenskar is among the best billing integration software options in India. While there are many solutions available, Zenskar offers extensive features tailored to Indian markets. It integrates seamlessly with multiple payment gateways and financial systems, simplifying the billing process.

Can you automatically adapt customized pricing models?

Yes, automated billing software allows you to adapt customized pricing models automatically. Without automation, updating pricing models manually is time-consuming and prone to errors. Automated systems provide flexibility to adjust pricing quickly and accurately, responding to market changes or customer needs efficiently.

How does automated billing software integrate with existing ERP or CRM systems?

Automated billing software typically features robust APIs and pre-built integrations that allow for seamless connectivity with ERP and CRM systems, ensuring data flows accurately and efficiently between platforms.

Can automated billing handle international transactions and multi-currency billing?

Yes, modern automated billing systems are equipped to handle international transactions, support multiple currencies, comply with local tax laws, and adjust for currency fluctuations to facilitate global business operations.

What role does AI play in enhancing automated billing systems?

AI enhances automated billing by analyzing payment patterns to predict future behaviors, optimizing billing schedules based on customer habits, and personalizing payment reminders to increase collection rates and customer satisfaction.

How can automated billing systems assist with regulatory compliance and financial auditing?

Automated billing systems ensure compliance with financial regulations by maintaining accurate records, automating tax calculations, and generating detailed reports that are essential for audits and adhering to standards like GAAP or IFRS.

How does automated billing improve financial forecasting and analysis?

Automated billing provides real-time access to financial data, which enhances forecasting accuracy. The system’s ability to generate detailed reports allows for deeper analysis and more informed strategic decision-making.

Can automated billing software support tiered pricing models and discounts?

Automated billing software can easily handle complex pricing structures, including tiered pricing and discounts. It automatically applies different pricing rules based on the volume of services used or the contract terms, ensuring accuracy and compliance.

Make your competitors copy your SaaS blogs with Dashify’s content writing services.